The most direct way to place an economic value on a risky asset is to observe the value of that asset in the financial markets, attributing the difference between the observed price and the price that might prevail without risk to the value of the risk.

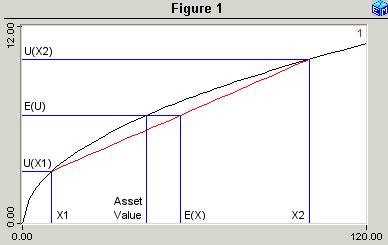

Economics also studies the theory of risk valuation for agents with curved utility functions. The theory shows that, if an agent's utility function features diminishing marginal utility of money, then that agent will be risk averse. We can quantify the degree of that risk aversion for particular risky assets.

![]() Model Link: Utility-Based Valuation of Risk

Model Link: Utility-Based Valuation of Risk

<activate

the model links>

Printable PDF Exercises

This

EconModel application studies a simple numerical example that captures the

flavor of the theory. An agent contemplates an asset with two possible

values, X1 and X2. The probabilities of these values are 1-P and P.

This

EconModel application studies a simple numerical example that captures the

flavor of the theory. An agent contemplates an asset with two possible

values, X1 and X2. The probabilities of these values are 1-P and P.

To develop an intuitive understanding of this theory, the EconModel application lets the user change X1, X2, and P and redraw the diagram. These steps will show how the value of the risk depends on the spread between the good and bad outcomes and the probabilities of those outcomes.

Classic Economic Models

Macroeconomics

Introduction

Overview of Macro Models

Models in Chronological Order

The Classical Model

The Simple Keynesian Model

The Keynesian IS/LM Model

The Mundell-Fleming Model

Real Business Cycles

The IS/MP Model

The Solow Growth Model

Financial Markets

Utility-Based Valuation of Risk

Mean-Variance Analysis:

Risk vs. Expected Return

Fixed Income Securities:

Mortgage/Bond Calculator

Growth Investments:

Present Value Calculator

Microeconomics

Introduction

Overview of Micro Models

Supply and Demand

Basic Supply and Demand

Who Pays a Sales Tax?

The Cobweb Model and

Inventory-Based Pricing

Theory of the Firm

Perfect Competition

Monopoly and

Monopolistic Competition

Price Discrimination

The Demand for Labor

Theory of the Consumer

Two Goods - Two Prices

Intertemporal Substitution

Labor Supply, Income Taxes,

and Transfer Payments

Resources